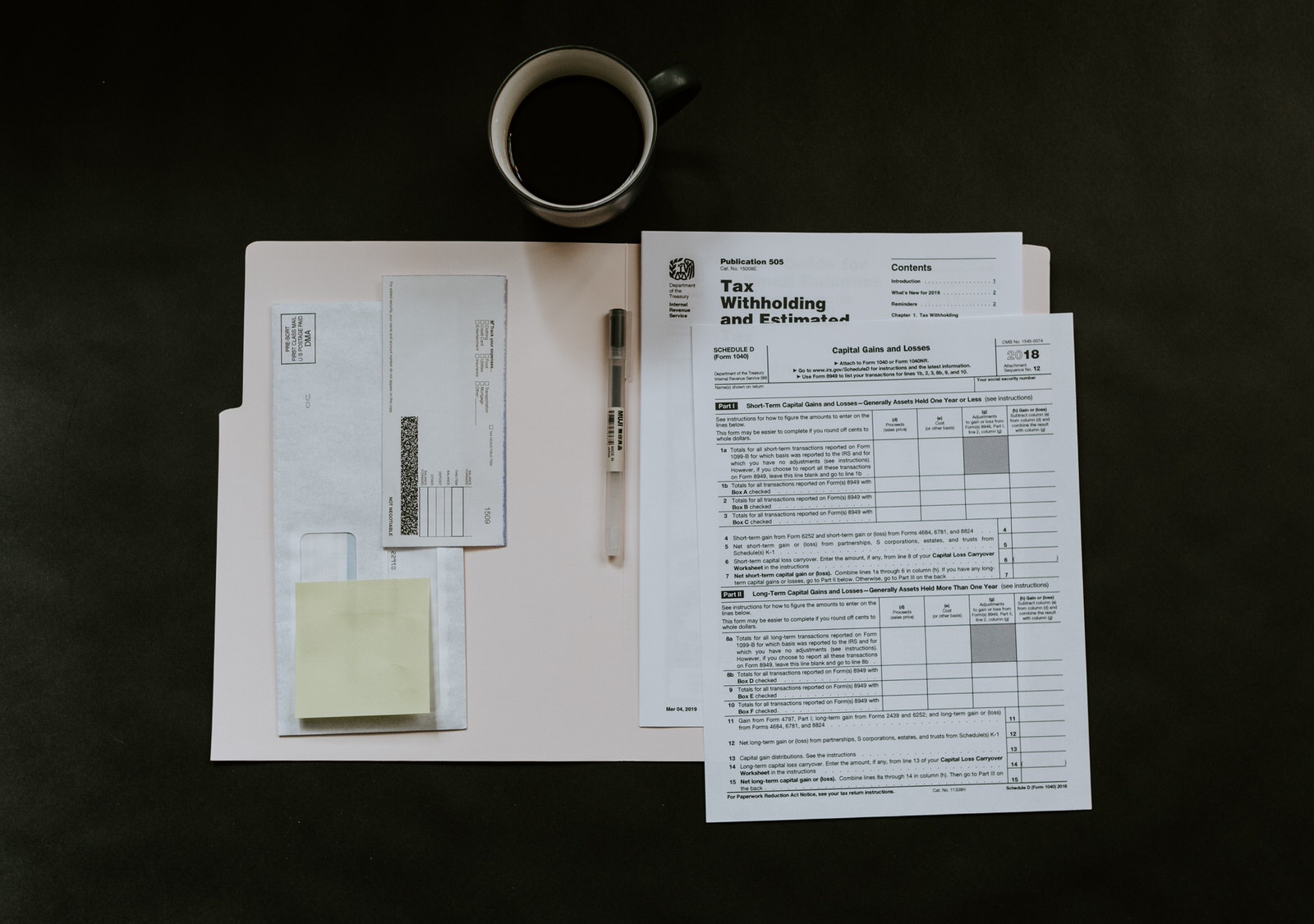

Running a small business is filled with challenges — and one of the trickiest obstacles to overcome is paying your taxes.

- What taxes do you have to pay? 💰

- When do they need to be paid by? 🗓

- How can you reduce your tax bill? 🤑

- How can you simplify your tax returns? 🤔

These are just some of the questions us wedding photographers will have to face as tax season is in full swing.

(Yes, already! 🤯)

We have decided to bring you all the tax tips in today’s article, to help you get your head around taxes once and for all.

We’ll be breaking down the basics, answering some of the most common questions and sharing our top tips for making Tax Day as hassle-free as possible.

Sound good?

Then let’s get started 💪

Breaking down the basics of small business tax

Before we share our top tax tips, let’s take a few steps back and break down what taxes you might need to pay, how much they might cost you and when you’ll need to pay them by.

Do keep in mind, though, that you should always consult an accountant for advice and guidance that’s specific to you. We’ll run through the facts, but only a professional will be able to assess what applies to you and what doesn’t.

Tax deadlines

So, first things first — all federal income taxes in the US are due on April 15th, 2021.

This means that you’ll have to send in your annual tax returns by this date or contact the IRS — the Internal Revenue Service — to arrange a payment plan or extension if that isn’t going to be possible.

If you are self-employed, you’ll most likely be paying quarterly taxes throughout the year which are also known as estimated taxes. You should visit the IRS website to check if this applies to you and when you’ll need to pay them by.

In a nutshell though, you should expect to pay quarterly taxes in April, June, September and January if your tax liability for the year is $1,000 or more — or $500 if you’re a registered corporation.

Common small business taxes

The taxes you pay will depend on your business structure.

In the US, there are three main business types.

To briefly summarize, these are:

- Sole proprietorships: businesses with one owner 🙋♀️

- Partnerships: businesses with more than one owner 👭

- Corporations and LLCs: businesses that are separate entities from their owners 💼

The majority of wedding photography businesses are either sole proprietorships or partnerships. The most common taxes incurred by these business types include:

- Income tax: this will range from 10-37% depending on your taxable income.

- Self-employment tax: which is currently set at 15.3% of your taxable income.

- Payroll taxes: if you have employees, you’ll have to pay various payroll taxes.

- Property tax: if you have a physical property for your business, you’ll have to pay a tax ranging from 0.18-1.89% depending on the state you’re in.

So, how much should you put aside to pay for tax each year?

Of course, this will vary for every photographer depending on:

- Your business structure 🏢

- Your yearly income 📈

- Your assets (like investments and property) 🏠

- Your expenses 💸

- Number of employees (if any) 👭

- The state you’re based in 🌍

All in all, though, research has shown that in the US, the effective small business tax rate is 19.8% percent. This means that, collectively, small businesses pay an average of 19.8% of their incomes in tax each year.

However, when we break it down into business structures, this can vary quite significantly:

- Sole proprietorships pay a 13.3% tax rate 🙋♀️

- Small partnerships pay a 23.6% tax rate 👭

- And small corporations pay a 26.9% tax rate 💼

It’s important to check in with an accountant to have your exact, combined rate confirmed, however, to help you put aside the correct amount for each quarter.

And how do you pay your taxes, exactly?

Well, the IRS is open to a number of payment methods.

These include:

- Electronic funds withdrawal, where you’ll pay when you e-file your tax returns 💻

- Direct pay, where you’ll pay directly from your bank account 🏦

- Credit or debit cards, where you can transfer money online or on the telephone 💳

- Cash payment, where you can deposit physical cash at a participating retailer 💼

- An online installment agreement, where you’ll pay a set amount each month 📅

Alongside each of these payment methods, you’ll also have to provide the necessary information and file the required forms. You can check out this IRS support page here to work out what you’ll need to submit and when by.

All of this can get pretty confusing — especially when it comes to the form filling — so, it’s worth reaching out to an accountant if you haven’t done so already. Any mistakes could be costly, so it’s better to be safe than sorry!

6 Top Tax Tips — how to handle your taxes, hassle-free

So, now we’ve covered the basics of small business taxation, let’s go ahead and break down some of the top ways you can simplify your tax returns and avoid any mishaps along the way.

1) Use online tax tools

Online tax tools are an absolute must for simplifying, organizing and optimizing your tax returns. Without them, paying your taxes could get pretty messy… and fast!

Take QuickBooks Self-Employed, for example.

It’ll help you:

- Prepare your tax returns 📈

- Track and record your expenses 🧐

- Calculate your quarterly taxes 📅

- Categorize your transactions into tax categories 💳

- Assess whether you’re due a tax refund 💰

- Avoid late fees or IRS penalties ❌

- And so, so much more 🙏

Basically, you should think of it as your very own accountant on demand… without the hefty fees! It connects directly to Turbotax and gets you ready for filing your taxes in no time. What’s not to love?

Get your head around expenses

Online tools will help you do this but having a good understanding of expenses is really important when it comes to paying your taxes.

Why?

Because you only pay tax on your taxable income — which is your annual (or quarterly) revenue minus your business expenses.

This could make a huge difference to the amount of tax you have to pay in a given period.

If, for example, you made $50,000 in a year, but $10,000 of that was spent on expenses, you’ll only have to pay tax on $40,000. Woohoo!

But what is a business expense, exactly?

Well, in a nutshell, it’s any cost you’ve incurred to run your business.

For photographers, this will include things like:

- Travel expenses (like flying out for a shoot) ✈️

- Venue expenses (say, if you hire a spot for a styled shoot) 💒

- Training and education costs 🎓

- Marketing costs (including your website fees and PPC ads) 📣

- Equipment costs 📸

- Home office deductions (including office furniture) 🖥

- Business utility bills (including your work phone bill) 🧾

- Insurances 💰

- Studio and storage space 📦

- Client meals (50% off the bill is classed as an expense) 🍴

- Client gifts ($25 per client is tax free) 🎁

- Legal expenses 👩⚖️

- Accountancy fees 📈

- Employee wages 💸

- And so much more!

Add all of that together, and most photographers will be in for some major tax breaks — which brings us onto our next point…

3) Keep all your receipts

Now in line with that, it’s super important to keep all your business receipts and invoices each quarter to track and evidence your expenses.

This will help you to…

- Calculate your expenses if you fall behind in filing them 💸

- Evidence and prove your expenses to the IRS 🧐

- Verify all expenses with an accountant 👩💻

- Keep track of your outgoings vs your income 📈

Whenever you make a business expense, then, take a photo (or screen shot) of the receipt, file it away, and keep it secure for whenever it might be needed.

You can use designated apps to help you do this, like Expensify or QuickBooks Self-Employed, which will store and protect all your expense evidence online. QuickBooks Self-Employed also has a dedicated feature for receipt storing if you’d like to keep everything in one place.

4) Keep on top of your business transactions

Whilst you could rack up a whole load of receipts and work through them at the end of each quarter, it would be far more sensible to keep on top of your business transactions as consistently as you can.

To do this, it’s a good idea to have one bank account for your personal finances, and one for your business finances.

This isn’t a legal necessity for sole proprietorships, but it’ll certainly help to provide a constant and consistent overview of your business expenses, removed from your own personal expenditure.

This will be useful for reviewing your expenses, checking your outgoings and keeping a recorded documentation of what’s being spent and where.

5) Stay ahead of the game

For a smooth and stress-free Tax Day, it’s important to keep on top of your finances all year long, no matter how far your tax deadline might be.

This means:

- Recording all expenses each week 🧐

- Filing all receipts 🧾

- Consistently reviewing your outgoings and income 📈

- Preparing your tax returns well in advance 💰

- Keeping all financial documentation secure and up to date 👩💻

The bottom line here is that you don’t want to have to panic at the beginning of April and struggle to get everything together in time. Instead, stay organized, and treat every day like tax day. It’ll save you a whole load of stress later down the line!

6) Hire an accountant

Yes, if you haven’t already guessed… we think accountants are total life saviors!

Let’s be honest here — most of us photographers aren’t exactly number crunchers. Sure, we love to run our businesses and can handle the basics, but accountancy usually isn’t one of strong points. We’re creatives, after all, not mathematicians!

This is why outsourcing our tax returns, or at least having them checked over by an accountant, is so important.

They’ll save you a whole lot of money by saving you time, maximizing your expenses, and avoiding any penalty fees from incorrect data.

So, if you think an accountant ‘isn’t worth the price tag’ — think again.

Without one, your tax returns could end up costing you even more than they need to.

The countdown to tax day is on…

But don’t fret!

Although filing your tax returns is never going to be fun, it doesn’t have to be the nightmare you fear. Understand the basics, follow our tips, and tax day can quickly become just another day in the office.

Now, there’s a thought!

Good luck, and don’t forget to check out our blog for more advice on running your wedding photography business.

Connection is what it’s all about. Feel free to reach out to us with any comments or questions you might have, even if it’s only to say hello. If it wasn’t for our beautiful community, this place just wouldn’t feel the same.

-->

-->

0 Comments